Va Unemployment Contact Email

contact email unemployment wallpaperBox 26441 Richmond VA 23261-6441. The legislatures Commission on Unemployment discussed the proposals in a Wednesday meeting outlining bills that among other things would reduce the programs reliance on paper mail and.

Quick Business Loans For Startups In Sydney Business Loans Loan Quick Loans

Contact your states unemployment insurance program for more information and to apply for benefits.

Va unemployment contact email. Alexandria 22312-2319 703 813-1300 or toll free. Box 26441 Richmond VA 23261-6441. This option does not use the California Relay Service and is recommended.

Contact Us - skip to page content. 866-832-2363 815am to 430pm Monday - Friday and 9am to 1pm on Saturday closed Sunday and state holidays Mailing Address PO. Virginia Relay call 711 or 800-828-1120.

Teletypewriter TTY at 1-800-815-9387. Anonymously report Unemployment Insurance Fraud to the VEC by calling 1-800-782-4001. I cant get through Ive emailed Ive called By Olivia Ugino July 16 2020 at 317 PM EDT - Updated July 16 at 617 PM.

There are a variety of benefit and aid programs to help you if you lose your job. Lawmakers say they plan to propose legislative fixes next month to speed unemployment claims in Virginia which ranks last in the country for quickly processing applications that require staff review. It can help with unemployment insurance benefits job training and finding a job.

866-832-2363 815am to 430pm Monday - Friday and 9am to 1pm on Saturday closed Sunday and state holidays Mailing Address PO. 866-832-2363 703 813-1380 Bristol Unemployment Office. Anonymously report Unemployment Insurance Fraud to the VEC by calling 1-800-782-4001.

Email the VEC at or call 804 786-7159. The Greater Peninsula Workforce Boards Virginia Career WorksHampton Center along other partner agencies offers a comprehensive range of services to address the workforce needs of both job seekers and businesses. Facing the threat of a class-action lawsuit Virginia officials said this week they will stop halting unemployment benefits after theyve been started without first conducting a review.

Apply for and manage the VA benefits and services youve earned as a Veteran Servicemember or family memberlike health care disability education and more. Apply for Unemployment Benefits. WorkForce West Virginia - Find resources for finding a job collecting unemployment benefits information about the labor market resources for veterans and news about employment conditions in West Virginia.

NoteIf you receive a phone call from the EDD your caller ID may show St of CA EDD or the UI Customer Service number 1-800-300-5616. If you have any comments or questions about New Employer Registration. 866-832-2363 815am to 430pm Monday - Friday and 9am to 1pm on Saturday closed Sunday and state holidays Mailing Address PO.

Box 26441 Richmond VA 23261-6441. Box 26441 Richmond VA 23261-6441. Call the Virginia Department of Taxation at 804 367-8037.

Virginia Relay call 711 or 800-828-1120. Email the VEC at employeraccountsvecvirginiagov or call 804 786-3061. Deaf and Hard of Hearing Customers.

Virginia Relay call 711 or 800-828-1120. 866-832-2363 815am to 430pm Monday - Friday and 9am to 1pm on Saturday closed Sunday and state holidays Mailing Address PO. Virginia Relay call 711 or 800-828-1120.

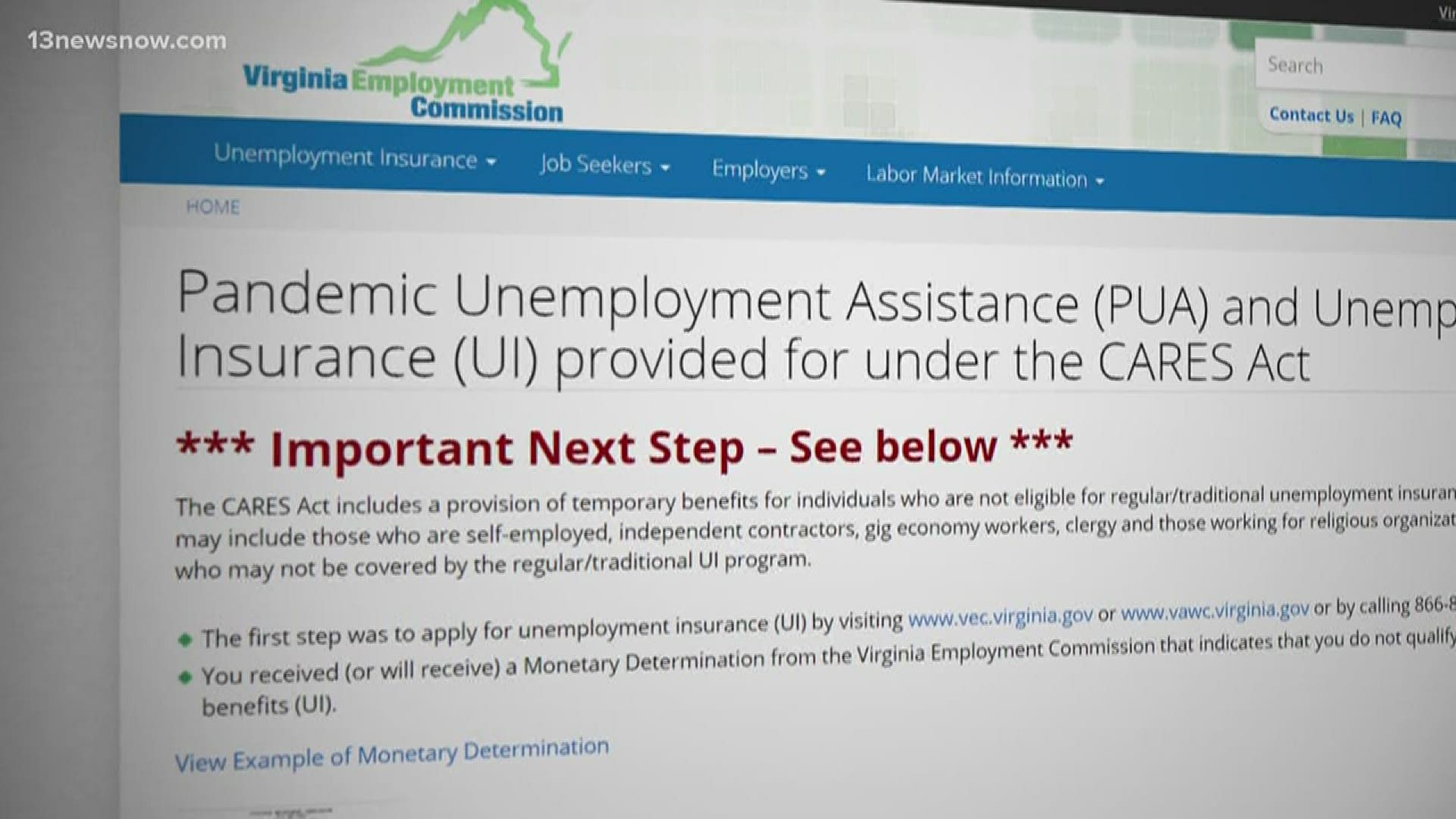

Email the VEC at or call 804 786-1082. Fogg said the best way to get in contact with VEC about problems is by sending an email to customer service at customerservicevecvirginiagov with your phone number included so someone can call. Pandemic Emergency Unemployment Compensation PEUC PEUC Webpage UC Email.

Benefits help The agency has set up an e-mail hot line customerservicevecvirginiagov and a toll-free phone number 866 832-2363 that people can call with questions on the unemployment. Anonymously report Unemployment Insurance Fraud to the VEC by calling 1-800-782-4001. UChelppagov Provide your full name as it appears on your claim including any suffix used and the last four digits of your Social Security Number.

Anonymously report Unemployment Insurance Fraud to the VEC by calling 1-800-782-4001. Alexandria Unemployment Office 5520 Cherokee Ave. UC Live Chat Monday - Friday from 7 am.

Unemployment issues persist in Virginia. If you have general questions about Virginia Unemployment tax. The Charlottesville-based Legal Aid Justice Center says the decision means payments will resume for thousands of unemployed Virginians who had their benefits cut off after for instance an.

The Virginia Employment Commission VEC says unemployment benefits are being paid out to Virginians who did not exhaust their weeks in 2020 through the CARES Act benefit programs but there is. Deaf and hard of hearing callers can contact EDD using one of the following.

Va Unemployment Ui Employer Type

employer unemployment wallpaperWorkForce West Virginia - Find resources for finding a job collecting unemployment benefits information about the labor market resources for veterans and news about employment conditions in West Virginia. In order to file for Unemployment Insurance UI you must have been separated from your employer or have had your hours reduced.

Https Floridajobs Org Docs Default Source Reemployment Assistance Center Cares Act Peuc To Pua Guidance Pdf Sfvrsn 651a4bb0 2

States like Oklahoma Virginia and Texas dont plan to issue those funds for a few.

Va unemployment ui employer type. Thousands of workers who filed for benefits but whose. Unemployment insurance UI also called unemployment benefits is a type of state-provided insurance that pays money to individuals on a weekly basis when they lose their job and meet certain. Anonymously report Unemployment Insurance Fraud to the VEC by calling 1-800-782-4001.

The Virginia Employment Commission VEC handles claims for benefits under the Virginia Unemployment Compensation Act. If your small business has employees working in Virginia youll need to pay Virginia unemployment insurance UI tax. We establish the issue and that stops any additional payments from going out Bill Walton the Director of Unemployment Insurance Services for the Virginia Employment Commission said.

The UI tax funds unemployment compensation programs for eligible employees. If you have questions about whether youre eligible for unemployment benefits read our COVID-19 Unemployment Benefits and Insurance FAQ and check out Virginias claimant handbook. In order to obtain your partial benefits you must enter the names of other employers for which you worked during the week the gross wages earned from eachsign the form and return it to the VEC Benefit PaymentCharge Unit PO.

Anonymously report Unemployment Insurance Fraud to the VEC by calling 1-800-782-4001. Virginia Relay call 711 or 800-828-1120. Box 26441 Richmond VA 23261-6441.

WRIC Virginians waiting for unemployment benefits could get an unexpected check from the Virginia Employment Commission. WWBT - The Virginia Employment Commission VEC has launched the application portal to the federal Pandemic Emergency Unemployment Compensation PEUC benefits program. Your last employer was a federal civilian employer in a state other than Virginia you must file your claim against the state in which you last worked.

Eligibility Requirements Whether you qualify for benefits in Virginia depends upon three factors. The second separation is from an employer for whom the claimant worked. You should not attempt to file a Virginia claim if.

866-832-2363 815am to 430pm Monday - Friday and 9am to 1pm on Saturday closed Sunday and state holidays Mailing Address PO. 866-832-2363 815am to 430pm Monday - Friday and 9am to 1pm on Saturday closed Sunday and state holidays Mailing Address PO. 866-832-2363 815am to 430pm Monday - Friday and 9am to 1pm on Saturday closed Sunday and state holidays Mailing Address PO.

The eligibility requirements can be found at. Other important employer taxes not covered here include federal UI tax and state and federal withholding taxes. Virginia Relay call 711 or 800-828-1120.

Virginia Relay call 711 or 800-828-1120. We must adjudicate any separation subsequent to the exhaustion of UI providing it does not occur prior to a separation from a 30-day or 240-hour employer. The 900 billion Covid relief law extends unemployment benefits in two programs PUA and PEUC by up to 15 weeks.

Because the coronavirus pandemic has left so many Americans jobless the federal government has given states more flexibility in granting unemployment benefits. All other non-profit employers are required to file as is any other business Churches however are always exempt from UI reporting. Box 26441 Richmond VA 23261-6441.

Box 26441 Richmond VA 23261-6441. Any complaints relating to the provision of services to job seekers or employers should be sent to the State Monitor Advocate Michelle Castellow Abraham at the Virginia Employment Commissions Central Office 6606 West Broad Street 5th floor Richmond VA 23230 or by calling 804 786-6094. Virginia law specifically exempts from unemployment taxes only nonprofits companies that have a 501 C3 federal tax exemption and have less than 4 employees for 20 weeks in the year.

The Virginia Employment Commission said Wednesday it will work to implement unemployment insurance provisions in the new COVID-19 relief package as soon as possible but that the agency is still. A monetary qualification a separation qualification and a weekly qualification. Box 27887 Richmond VA 23261-7887 within 14 days of the date the employer gives it to you.

Virginia Relay call 711 or 800-828-1120. Box 26441 Richmond VA 23261-6441. In Virginia state UI tax is just one of several taxes that employers must pay.

866-832-2363 815am to 430pm Monday - Friday and 9am to 1pm on Saturday closed Sunday and state holidays Mailing Address PO. Anonymously report Unemployment Insurance Fraud to the VEC by calling 1-800-782-4001. Anonymously report Unemployment Insurance Fraud to the VEC by calling 1-800-782-4001.

The claimant has three separations subsequent to the exhaustion of UI. Virginia law applies in this case.