Imf Finance Sa

finance wallpaperThis assessment of the current state of the implementation of the Basel Core Principles for Effective Banking Supervision in South Africa has been completed as a part of a Financial Sector Assessment Program update undertaken by the International Monetary Fund IMF during 2014. The IMFs research highlights how the uneven playing field between women and men imposes large costs on the global economy.

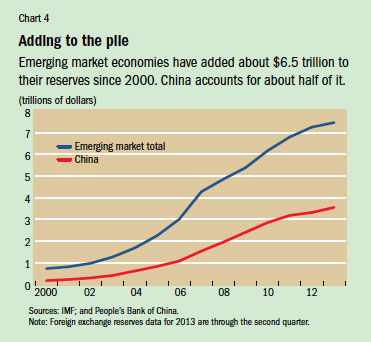

The Dollar Reigns Supreme By Default Finance Development March 2014

The Dollar Reigns Supreme By Default Finance Development March 2014

State-owned enterprises SOEs risks are materializing triggering government bailouts of Eskom and administrative intervention in other entities.

Imf finance sa. It has been touted in the. The view that South Africa should look towards the International Monetary Fund IMF to be rescued from the unfolding economic meltdown seems to be growing by the day. Nonresident investors are shedding equities and local currency bonds but showing.

Policy support is key to financial stability with IMFs Fabio Natalucci SDR Rates for February 11 2021 SDR Interest Rate 0090 1 USD SDR 069329 MORE The IMF and COVID-19. The International Monetary Fund IMF has approved a R70 billion US43 billion loan for South Africa to help the country manage the immediate consequences of the fallout from Covid-19. Government Finance Statistics Yearbook GFSY.

South Africa now has less than a 33 chance of securing an IMF International Monetary Fund bailout this year new research projects. Our investment activities cover 3 areas. High fiscal deficits have boosted debt.

This means that the funds to repay the IMF are properly budgeted for. It reflects the regulatory and supervisory framework in place as of the date of the completion of the assessment. Early IMF studies on the economic impact of gender gaps assumed that men and women were likely to be born with the same potential but that disparities in access to education health care and finance and technology.

COVID-19 Financial Assistance and Debt Service Relief The IMF is providing financial assistance and debt service relief to member countries facing the economic impact of the COVID-19 pandemic. The International Monetary Fund IMF has approved a request from South Africa for emergency financial support under the Rapid Financing Instrument RFI for an amount of 43 billion R706. The IMF requires that SA repay the funds to the IMF over 20 months beginning 40 months after the loan is disbursed.

There is no reason why South Africa would not be able to repay its obligations says the International Monetary Funds IMF senior representative to South Africa Montfort Mlachila. Reform or rot gloomy IMF warns SA IMF has cut its growth forecasts for SA and warned that its more critical than ever for the country to tackle its long-standing fiscal and. The SDR Interest Rate is posted every Monday.

It would also seem too easy for the IMF to try to curry favour by providing SA with easy finance without attaching conditions to reform the economy. Rates for February 11 2021 Interest Rate 0090 1 USD SDR 069329 MORE The IMF posts Representative and SDR exchange rates daily Monday to Friday except for these holidays. IMF Finance SA is a family owned and run investment company.

Opposition to the IMF has remained a shibboleth of the party. Subdued private investment and exports and increased uncertainty have depressed growth and worsened social indicators. Yet on July 27th South Africa said it had agreed to a 43bn loan from the IMF.

And social and cultural factors. The deal signed by South Africa one of 78 countries to. Her view she told Reuters in an interview was predicated on the hope that the Europeans could put.

However if the SA government and IMF choose. Having received 43 billion in emergency financing from the. Christine Lagarde then Frances finance minister and now head of the IMF agreed with Sarkozy.