Military Spouse No State Tax

military spouse wallpaperWhen the nonmilitary spouse meets the above qualifications their wages from services performed in that new state will only be taxed in their resident state not by the state they are currently living in. The income earned for services performed in North Carolina by a spouse of a servicemember who is legally domiciled in a state other than North Carolina is not subject to North Carolina income tax if.

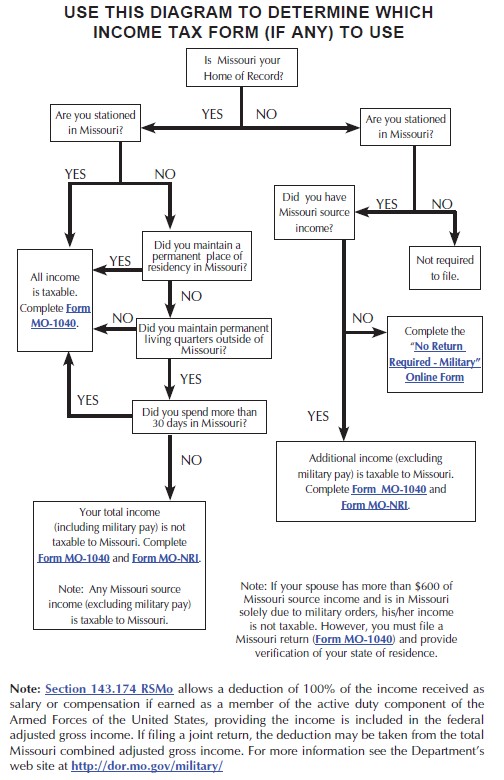

Whiteman Air Force Base Community Tax Toolkit Missouri Taxes

Whiteman Air Force Base Community Tax Toolkit Missouri Taxes

Both the service member and spouse have the same resident state.

Military spouse no state tax. You must correct your Form MW507 filing if you had entered EXEMPT on line 8 of that form. If you are a military spouse you may have been told that you do not have to pay North Carolina income taxes due to The Military Spouses Residency Relief Act of 2009. Some employees whether they work in HR at your new job or at the local DMV may not know the exemptions and rights that you have as a military spouse or dependent.

However military income is subject to tax only by the state of domicile. Military personnel should be aware that there may be provisions for tax credits granted either by Maryland or another state when the same income is subject to tax by both states. Up to 6250 plus 50 of retired pay over that amount is tax-free for 2019.

That will increase to 75 in 2021 and 100. This is true only if the you meet these requirements. They may get a tax credit from their state of residence for what they paid in taxes as a non-resident.

This does not mean the spouses state of legal residence cannot tax on income earned. This is not entirely true. Under the Military Spouses Residency Relief Act signed into law on November 11 2009 military spouses who earn income in the state where their spouse is stationed may be able to claim either the.

The service member is stationed in compliance with military orders in a state that is not their resident state. Military spouse income earned in a servicemembers state under military orders cannot be taxed unless the spouse establishes residency in that state. For military spouses there is a significant change as part of the Veterans Benefits and Transition Act of 2018.

You go with the service member to a duty station state outside your home state due to military orders. See Maryland Form 502CR and instructions. The Problems With This Law There are numerous issues that arent addressed in this law and there are some constitutional question.

Your spouse already reports military pay to their state of legal residence. Your Form W-4 which tells your employer how much to withhold from your wages should reflect that. Recently retired or separated members may also be eligible for benefits.

If your home of record is in another State and are stationed in Connecticut you are a nonresident and your military pay is not subject to Connecticut income tax. Military pay is not subject to income tax in the state where you are stationed unless it is also your state of legal residence. However other income that you receive from Connecticut sources while you are a nonresident may be subject to tax.

According to the North Carolina Department of Revenue NCDOR tax-exempt status for a military spouse can only be acquired if the spouses domicile is the same state as that of the service member. Under this law all military spouses will be able to claim that same state for purposes of income tax and voting meaning that a lot of folks will be able to take advantage of no state income taxes. But if your spouse earns non-military income from a second job they could owe income tax in the state where you are stationed.

Exemptions and deductions must be adjusted. If you checked NO to any of the statements in item 1 do not continue because you do not qualify for exemption from Maryland withholding tax for a qualified civilian spouse of a US. Active duty or reserve members of the armed forces listed below may be eligible for military tax benefits.

Generally speaking the state that you live and work in during any given tax year is the state in which you are required to pay taxes. The nonmilitary spouse is in that state solely to live with the service member. FS-2020-03 February 2020 The Internal Revenue Service is committed to helping military members veterans and their families meet their federal income tax filing obligations.

But if they earn income from a civilian or non-military job they will need to report those wages as a non-resident in the state where you are currently living. Up to 5000 of military income is tax-free. If your spouse is in the military you likely move from state to state.

The military spouse residency rules state that if youre the spouse of a service member you dont lose or get a state of domicile or residence for taxation purposes when you move. Tax Lessons Learned as a Military Spouse January 16 2021 Over the past 10 years having been a military spouse I have learned a few lessons when it comes to taxes and fees when you move to a new location. This allows military spouses to elect to use their service members state of legal.

The military servicemember and spouse have the same home state domicilestate of legal residence or the spouse elects to use the servicemembers residence for state tax purposes even though the two did not share the same residence or domicile prior to the move under an amendment to the MSRRA by the Veterans Benefits and Transition Act of 2018 VBTA. The servicemember is present in North Carolina solely in compliance with military orders. Your spouses military pay is taxable by their state of legal residence.

This way multiple states and tax localities wont tax you when your spouse moves for military service.

As New Spouses Or Even Experienced Spouses Ahem We Sometimes Have No Idea What Our Milspouse St Milspouse Military Spouse Resources This Or That Questions

As New Spouses Or Even Experienced Spouses Ahem We Sometimes Have No Idea What Our Milspouse St Milspouse Military Spouse Resources This Or That Questions

5 Top Military Spouse Benefits Military Benefits

5 Top Military Spouse Benefits Military Benefits

Pin By Deborah Byerly Mcgee On Military What Is A Veteran Veteran Military

Pin By Deborah Byerly Mcgee On Military What Is A Veteran Veteran Military

Http Www Hawaiipublicschools Org Doe 20forms Military Militaryspousetaxexemption Pdf

Tax Tips For Two State Residents Military Com

Tax Tips For Two State Residents Military Com

Military Spouse Act Residency Relief Msrra Military Benefits

Military Spouse Act Residency Relief Msrra Military Benefits

Military Spouse Residency Relief Act

Military Spouse Residency Relief Act

Understanding State Tax Laws For Telecommuting Military Spouses Military Spouse State Tax Military Spouse Career

Understanding State Tax Laws For Telecommuting Military Spouses Military Spouse State Tax Military Spouse Career

Pcs Season Got You On The Job Hunt Yet Again Maybe Entrepreneurship Has Your Name Written Military Spouse Military Wife Life Military Spouse Appreciation

Pcs Season Got You On The Job Hunt Yet Again Maybe Entrepreneurship Has Your Name Written Military Spouse Military Wife Life Military Spouse Appreciation

Moaa Faq New Military Spouse Residency Rules

Moaa Faq New Military Spouse Residency Rules

Dear Coast Guard Family New Law That Affects Military Spouse Residency Coast Guard All Hands Archive

Dear Coast Guard Family New Law That Affects Military Spouse Residency Coast Guard All Hands Archive

State Of Legal Residence Vs Home Of Record Military Com

State Of Legal Residence Vs Home Of Record Military Com

Understanding The Military Spouses Residency Relief Act And How It Applies To State Taxes Military Spouse Work From Home Moms How To Apply

Understanding The Military Spouses Residency Relief Act And How It Applies To State Taxes Military Spouse Work From Home Moms How To Apply

Hard Parts Of Saying Goodbye To Military Life Airman To Mom Military Life Military Spouse Military

Hard Parts Of Saying Goodbye To Military Life Airman To Mom Military Life Military Spouse Military

Flying Space A Without Your Sponsor How Military Spouses Can Travel Solo Poppin Smoke Military Wife Life Army Wife Life Military Spouse

Flying Space A Without Your Sponsor How Military Spouses Can Travel Solo Poppin Smoke Military Wife Life Army Wife Life Military Spouse

As A Military Spouse Tax Rules For Civilians Can Seem Complex After Your Partner Has Spent Time In The Servic Tax Preparation Better Money Habits Money Habits

As A Military Spouse Tax Rules For Civilians Can Seem Complex After Your Partner Has Spent Time In The Servic Tax Preparation Better Money Habits Money Habits