Imf Tax Statistics

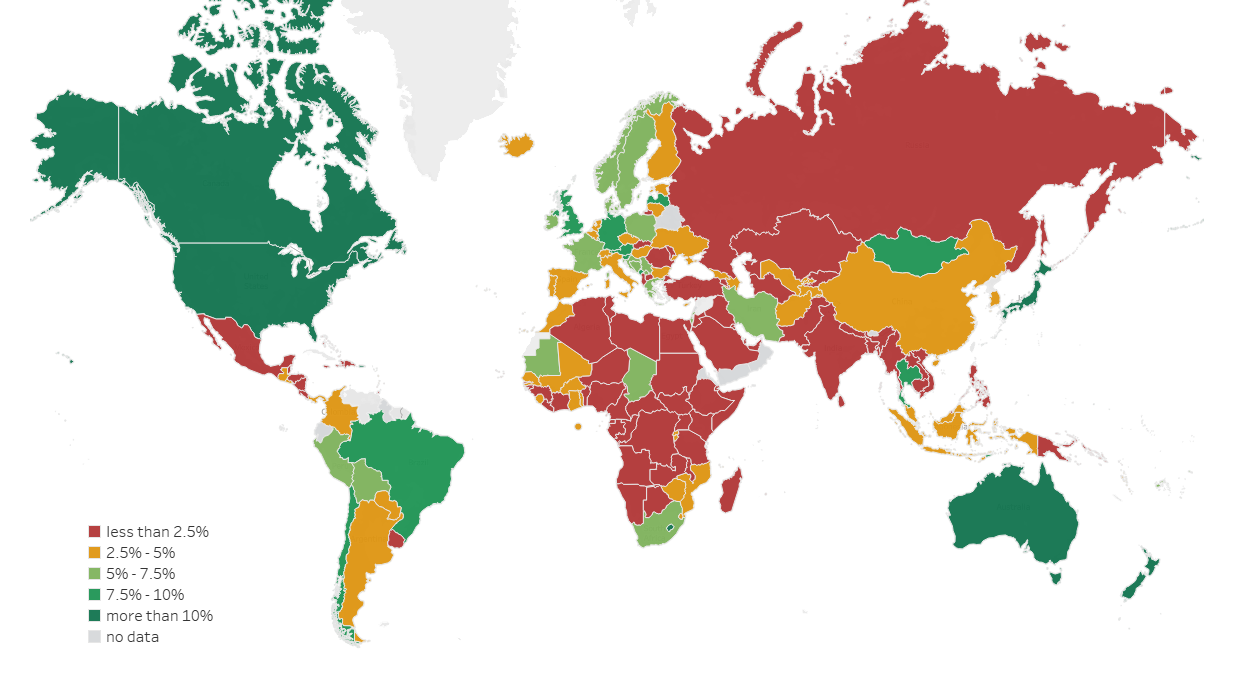

statistics wallpaperUtilizing digital tools in tax collection can also be part of a comprehensive strategy to boost domestic revenue. Median Tax Progressivity in Organisation for Economic Co-operation and Development Member Countries.

Tax rate change notices.

Imf tax statistics. Shabbar Zaidi chief of the federal tax collection body has said the measures were intended to streamline the economy and widen the tax base. Government Finance Statistics Yearbook GFSY. The IMF in a statement announcing the bailouts.

Even though the special purpose entity share is relatively low in some OECD countries the tax challenge can still be significant given developed economies generally relatively high outward foreign direct investment relative to their economic size. Globally the average is close to 40 percent. Your browser is not up-to-date.

Ministry of Finance 1 Melik Adamyan Street Room 233 Yerevan 0010 Armenia. For optimum experience we recommend to update your browser to the latest version. Manuals guides and other material on statistical practices at the IMF in member countries and of the statistical community at large are also available.

Concentration of Income above the 95th Percentile 19702012. The IMF managing director who succeeded Christine Lagarde last year said higher taxes on the better off the use of digital tools to boost tax collection and reducing corruption would help fund. The GFSM 2014 classifications remain.

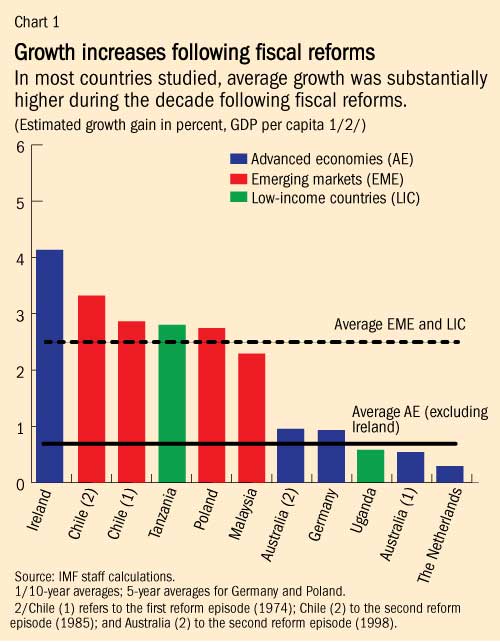

Progressive taxation is a key component of effective fiscal policy. Top Marginal Personal Income Tax Rate across Social Welfare Function Weight for Top. The Government Finance Statistics GFS contains data for all reporting countries in the framework of the Government Finance Statistics Manual 2014 GFSM 2014.

However after an initial boost from the 15 trillion tax cut package the IMF forecasts growth will slow steadily in future years dropping to 14 percent in 2023. Your browser is not up-to-date. At the top of the income distribution our research shows that marginal tax rates can be raised without sacrificing economic growth.

See current and past notices about changes to city and county sales tax rates. Rates are available alphabetically by citycounty by cities group by county and in Excel or QuickBooks file format. Policy support is key to financial stability with IMFs Fabio Natalucci SDR Rates for February 11 2021 SDR Interest Rate 0090 1 USD SDR 069329 MORE The IMF and COVID-19.

Top Statutory Personal Income Tax Rate over Time. Tax Rate Charts show how much sales tax is due based on the amount of a sale. The IMFs World Revenue Longitudinal Data set WoRLD is a compilation of government tax and non-tax revenues from the IMFs Government Finance Statistics and World Economic Outlook and drawing on t.

Tax revenue of GDP International Monetary Fund Government Finance Statistics Yearbook and data files and World Bank and OECD GDP estimates. GDP Gross Domestic Product Real Nominal Deflator Index Growth Change. Resident Representative for Republic of Armenia Yulia Ustyugova Resident Representative.

The IMF publishes a range of time series data on IMF lending exchange rates and other economic and financial indicators. For optimum experience we recommend to update your browser to the latest version.

China Zombie Debt Accounts For Small Slice Of Total Imf Says Financial Times Industrial Companies The Borrowers

China Zombie Debt Accounts For Small Slice Of Total Imf Says Financial Times Industrial Companies The Borrowers

I Knew Canadian And New Zealand Home Prices Have Gone Crazy But Colombia Threw Me For A Loop House Prices Global Home New Zealand Houses

I Knew Canadian And New Zealand Home Prices Have Gone Crazy But Colombia Threw Me For A Loop House Prices Global Home New Zealand Houses

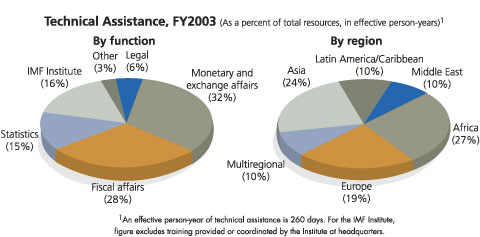

Imf Technical Assistance Transferring Knowledge And Best Practice May 2003

Imf Technical Assistance Transferring Knowledge And Best Practice May 2003

Pin On Sdg 10 Reduced Inequalities

Pin On Sdg 10 Reduced Inequalities

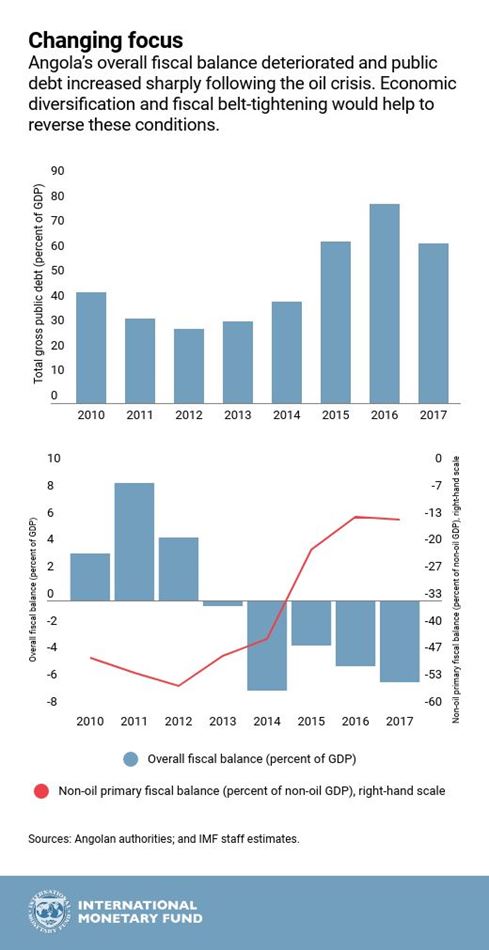

5 Charts That Explain The Global Economy In 2018 Imf Blog

5 Charts That Explain The Global Economy In 2018 Imf Blog

5 Things You Need To Know About The Imf And Gender Working Parent Gender Global Economy

5 Things You Need To Know About The Imf And Gender Working Parent Gender Global Economy

The Great Greek Bank Drama Act I Schaeuble S Sin Bin Deflation Market Consolidate Credit Card Debt Refinance Student Loans Federal Student Loans

The Great Greek Bank Drama Act I Schaeuble S Sin Bin Deflation Market Consolidate Credit Card Debt Refinance Student Loans Federal Student Loans

This Bar Graph Breaks Down Total Federal Income Tax Revenues By The Earnings Percentiles Of The Americans Who Paid Them Federal Income Tax Income Income Tax

This Bar Graph Breaks Down Total Federal Income Tax Revenues By The Earnings Percentiles Of The Americans Who Paid Them Federal Income Tax Income Income Tax

The Head Of The Imf Says Inequality Threatens Democracy Here Are 7 Charts Proving She S Right Blog Billmoyers Com Wealth Inequality Richest In The World

The Head Of The Imf Says Inequality Threatens Democracy Here Are 7 Charts Proving She S Right Blog Billmoyers Com Wealth Inequality Richest In The World

Imf International Monetary Fund 2019 Corporate Taxation In The Global Economy Policy Paper 19 007 March 10 Imf Wash Global Economy Economy Corporate

Imf International Monetary Fund 2019 Corporate Taxation In The Global Economy Policy Paper 19 007 March 10 Imf Wash Global Economy Economy Corporate

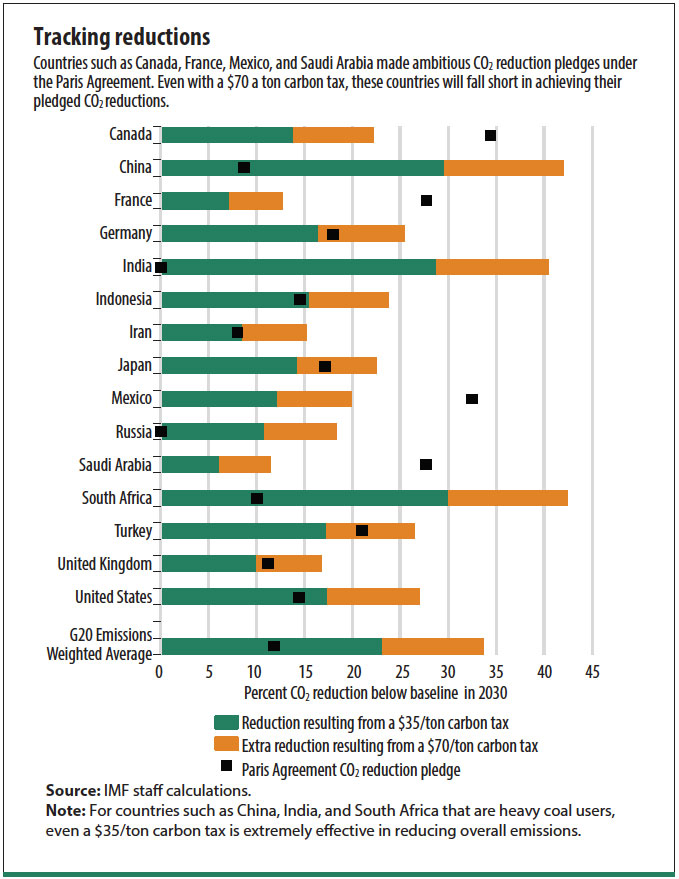

Back To Basics What Is Carbon Taxation Imf F D

Back To Basics What Is Carbon Taxation Imf F D