Us Treasury Notes Credit Rating

notes rating wallpaperFrom February 18 2002 to February 8 2006 Treasury published. -2210 -122 The USs AA credit rating was affirmed by Standard Poors which cited the resilience of the economy and the status of the dollar.

Are Chinese Credit Ratings Relevant A Study Of The Chinese Bond Market And Credit Rating Industry Sciencedirect

Are Chinese Credit Ratings Relevant A Study Of The Chinese Bond Market And Credit Rating Industry Sciencedirect

T-notes also.

Us treasury notes credit rating. It can also apply generally to a borrower independently of a particular instrument. Enjoyed the gold standard of triple-A ratings from all three agencies Fitch Moodys and SP from the time of their recognition as standards by the SEC until the SP downgrade in early August 2011. United States of America USD 38 bln 2875 treasury billsnotesbonds 31-Oct-2020.

Find the latest ratings reports data and analytics on US Treasury Securities. Treasury notes are similar to T-bills because they are also backed by the federal government but the maturities are longer - two to 10 years and pay interest every six months. DBRSs credit rating for the United States is AAA with stable outlook.

Government debt security with a fixed interest rate and maturity between one to 10 years. Standard Poors credit rating for the United States stands at AA with stable outlook. Treasury bills notes and bonds are fixed-income investments issued by the US.

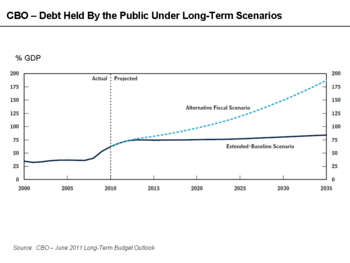

The risk of default carries more weight especially for higher-grade borrowers where that risk is considered low. They are the safest investments in the world since the US. However in August 2011 the long-term sovereign credit rating on the United States of America was downgraded to AA from AAA by the Standard Poors ratings agency reflecting increasing concerns about the US.

This low risk means they have the lowest interest rates of any fixed-income security. For credit ratings that are derived exclusively from an existing credit rating of a program series categoryclass of debt support provider or primary rated entity or that replace a previously assigned provisional rating at the same rating level Moodys publishes a rating announcement on that series categoryclass of debt or program as a whole on the support provider or primary rated entity or on the provisional rating but often does not publish a specific rating announcement on. The 2-month constant maturity series begins on October 16 2018 with the first auction of the 8-week Treasury bill.

Dial the ATT Direct Dial Access code for. Government enjoys the highest credit rating AAAAaa from two of the Big Three CRAs. Long TermShort Term Issuer Default Rating displayed in orange denotes EU or UK Unsolicited and Non-Participatory Ratings.

United States of America USD 28 bln Zero treasury billsnotesbonds 08-Oct-2020. Then at the prompt dial 866-330-MDYS 866-330-6397. United States of America USD 24 bln 1625 treasury billsnotesbonds 15-Oct-2020.

Using our convening authority Treasury invited six credit rating agencies to participate in an exercise over the last several months intended to provide market participants with greater transparency into their credit rating methodologies for residential mortgage loans. A credit rating is an opinion of both the risk of default on a loan instrument typically a bond and the loss in the event of default. Also known as T-notes treasury notes are similar to T-bonds but are offered in a wide range of terms as short as two years and no longer than 10 years.

The USs AA credit rating was affirmed by Standard Poors which cited the resiliency and diversity of the economy almost three years after downgrading the nation for the first time amid. Treasury notes are available either via competitive bids wherein an investor. In general a credit rating is used by sovereign wealth funds pension funds and other investors to gauge the credit worthiness of the United States thus having a big impact on the countrys borrowing costs.

30-year Treasury constant maturity series was discontinued on February 18 2002 and reintroduced on February 9 2006. Department of the Treasury. The USs strengths include a.

The Fund seeks preservation of principal and same day liquidity through the maintenance of a portfolio of high quality short-term government debt and repurchase agreements. United States of America USD 4526 bln 15 bondnote 30-Sep-2024. Moodys credit rating for the United States was last set at Aaa with stable outlook.

The Fund will invest in US Treasury bills notes and other obligations issued or guaranteed by the US Government and repurchase agreements where the associated collateral is secured by any of the preceding obligations. United States of America USD 4159 bln 175 bondnote 31-Jul-2021. United States of America USD 602 bln 2375 bondnote 15-May-2029.

Budget deficit and its future trajectory. Where there was a review with no rating action Review No Action please refer to the Latest Rating Action Commentary for an explanation of key rating drivers. A Treasury note is a US.

Nations With The Highest Share Of The Us Debt Pie Infographic Debt Foreign Countries Country

Nations With The Highest Share Of The Us Debt Pie Infographic Debt Foreign Countries Country

How To Apply For A Debt Relief Grant In 2020 How To Apply Technician Debt Relief

How To Apply For A Debt Relief Grant In 2020 How To Apply Technician Debt Relief

United States Federal Government Credit Rating Downgrades Wikipedia

United States Federal Government Credit Rating Downgrades Wikipedia

Infographics Detail Finance Investing Mutuals Funds Investing

Infographics Detail Finance Investing Mutuals Funds Investing

Bond Ratings Overview Examples List Of Bond Rating Systems

Bond Ratings Overview Examples List Of Bond Rating Systems

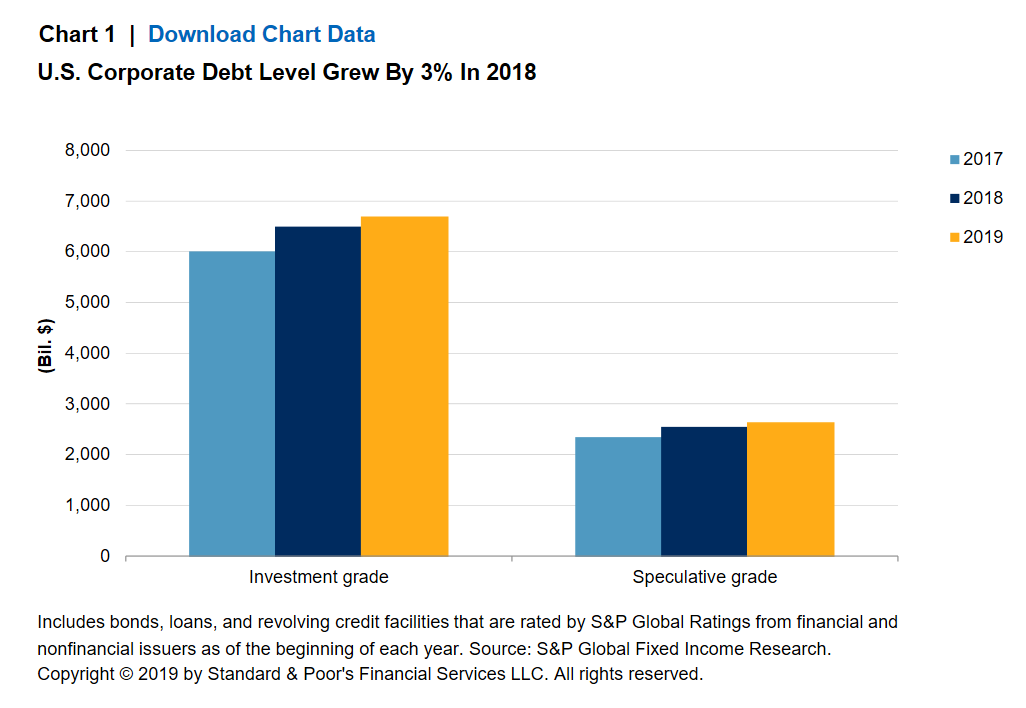

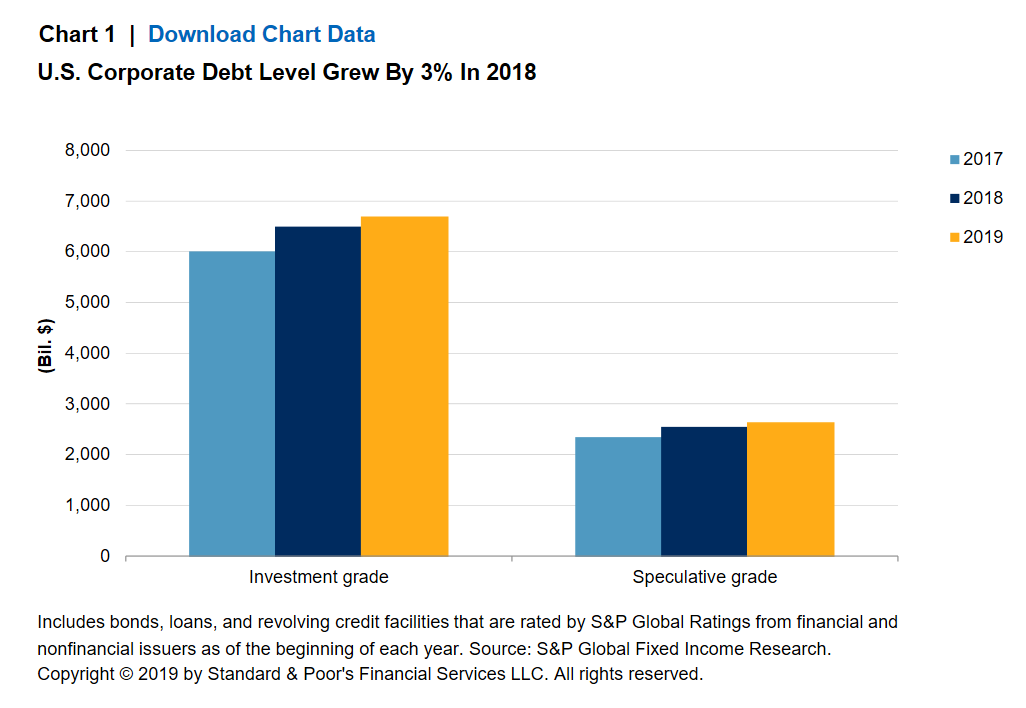

U S Corporate Debt Market The State Of Play In 2019 S P Global

U S Corporate Debt Market The State Of Play In 2019 S P Global

14k Gold Filled 100 Dollar Bill 100 Dollar Bill Money Collection Dollar Bill

14k Gold Filled 100 Dollar Bill 100 Dollar Bill Money Collection Dollar Bill

With Good Economic News Signalling Inflationary Pressures Comes Bad News On The Rate Front Not Possible I Guess To Have Your C The Borrowers Chart Finance

With Good Economic News Signalling Inflationary Pressures Comes Bad News On The Rate Front Not Possible I Guess To Have Your C The Borrowers Chart Finance

Video How Plastic Banknotes Are Made Australian Money How To Get Money Bank Notes

Video How Plastic Banknotes Are Made Australian Money How To Get Money Bank Notes

Home Page Our Deer In 2020 Credit Score Credit Reporting Agencies Scores

Home Page Our Deer In 2020 Credit Score Credit Reporting Agencies Scores

10 Things You Shouldn T Buy When You Are Struggling Financially Video Finance Saving Money Habits Financial Health

10 Things You Shouldn T Buy When You Are Struggling Financially Video Finance Saving Money Habits Financial Health

After Traveling Some Speaking With Lots Of People Reading And Digesting I Cannot Escape The Conclusion That Things Remain Hop Reality Check Reality Reading

After Traveling Some Speaking With Lots Of People Reading And Digesting I Cannot Escape The Conclusion That Things Remain Hop Reality Check Reality Reading

Bonds Cheat Sheet Cheat Sheets Cheating Primary Activities

Bonds Cheat Sheet Cheat Sheets Cheating Primary Activities

Corporate Credit Rating Scales By Moody S S P And Fitch Wolf Street

Corporate Credit Rating Scales By Moody S S P And Fitch Wolf Street

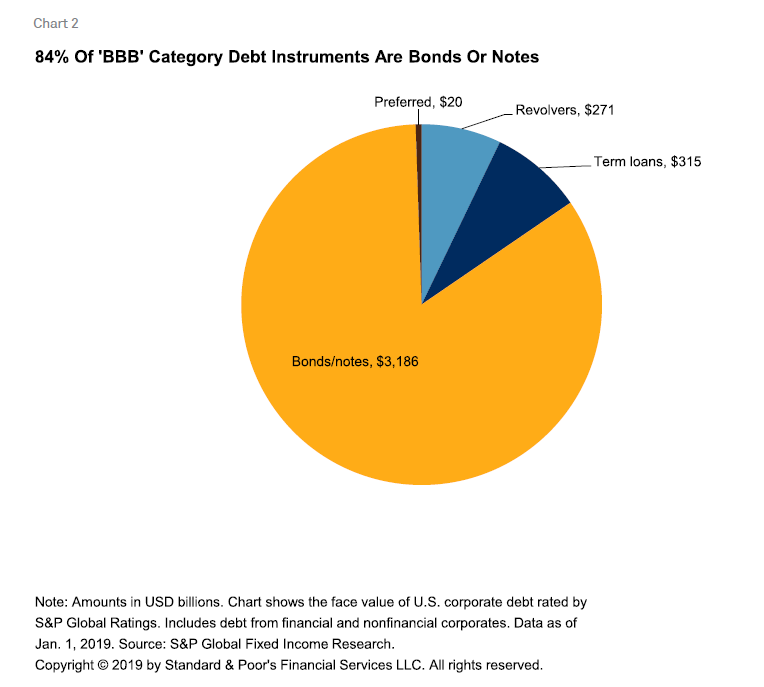

The Bbb U S Bond Market Exceeds 3 Trillion S P Global

The Bbb U S Bond Market Exceeds 3 Trillion S P Global

Treasury Is Starting To Send Some Stimulus Payments On Debit Cards Visa Debit Card Debit Prepaid Debit Cards

Treasury Is Starting To Send Some Stimulus Payments On Debit Cards Visa Debit Card Debit Prepaid Debit Cards

How To Start A Public Bank Public Banking Crisis Senior Advisor

How To Start A Public Bank Public Banking Crisis Senior Advisor

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Bonds_Rated_Sep_2020-01-b7e5fc745626478bbb0eed1fb5016cac.jpg)