Military Dependent In State Tuition Bill

dependent military stateEnsuring military dependents receive in-state tuition when admitted to the Montana University System. A 150 stipend per semester is included to help with books or fees.

Https Www Nvcc Edu Forms Pdf 125 097 Pdf

All active duty military and DoD employees and their spouses and dependent children are eligible for consideration to receive in-state tuition provided they are assigned to an active duty station in Pennsylvania and reside in Pennsylvania.

Military dependent in state tuition bill. Active service members and their dependents making use of the GI Bill can attend any out-of-state public college or university while paying the in-state tuition rate. Law Gives Dependent GI Bill. VA education benefits for dependents include options under the GI Bill Yellow Ribbon program and scholarship funds.

Bill of title 38 United States Code who lives in Missouri while attending a school located in Missouri regardless of hisher formal State of residence and enrolls in the school within three years of discharge or release from a period of active duty. Children between the ages of 16-26 qualify for a full tuition waiver at any state-funded post-secondary school. Armed Forces the Commissioned Corps of the USPHS or the Commissioned Corps of the NOAA if the dependent child resides in Maryland and is using the sponsors transferred Post-911 GI Bill benefits.

The Wisconsin GI Bill forgives full tuition and segregated fees for eligible veterans and their dependents for up to eight semesters or 128 credits whichever is greater at any University of Wisconsin System or Wisconsin Technical College System school. Scholarships for Military Dependents. If you are a military dependent wondering what your options from the VA might be much depends on the nature of the military members service time spent in uniform and what GI Bill program the member signed up for at the start of their military career.

Dependent children and spouses of Veterans who are using transferred entitlement GI. This means you may qualify for in-state tuition rates if Virginia is not your legal domicile. YES 3552h3ii Had GI Bill eligibility Chapter 33 - Post 911 transferred to me and exhausted but remained at same institution.

Bill benefits within 3 years of the transferors discharge after serving 90 days or more on active duty are eligible for in-state tuition and fee assessment. All United States military personnel on active duty their spouse or dependent children are eligible for in-state tuition rates. The Higher Education Opportunity Act of 2008 requires that states offer in-state tuition to military family members who live in the state due to their active duty military members service.

Dependents receiving Chapter 33 Post-911 or Chapter 35 Survivors and Dependents Educational Assistance of the GI Bill benefit or Fry Scholarship benefits will be eligible for in-state Penn State tuition regardless of where they reside. The current maximum tuition benefit is just over 20000. Dependent children of full-time active duty members of the US.

Learn more about UAF support for military veterans and their families. Bill Active Duty Program or chapter 33 Post-911 GI. Because of the Higher Education Opportunity Act of 2008 states need to offer in-state tuition to military family members who live in the state due to their active duty military service.

Military families will have to come up with any additional funding for private or public universities costing more than that. This means that for any active duty service member his or her spouse and dependents at any public college or university where they are stationed for 30 days should be able to receive the in-state tuition rate. The State of New Mexico offers free tuition to dependent children of qualifying veterans who were killed in action or died as a result of wounds sustained in battle.

As written the law does not guarantee in-state tuition without any qualifications for children and spouses of actively serving military members who are using transferred Post 911 GI Bill benefits. Have a spouse or parent currently stationed at a NY installation. A bill recently signed into law makes it so anyone using the post-911 GI Bill will receive in-state tuition rates regardless of how long they have lived in the state.

YES 3552h3i Had GI Bill eligibility Chapter 33 - Post 911 transferred to me. Individuals must remain continuously enrolled to continue eligibility. 5 Provides that a dependent or spouse of a person who serves on active duty in the armed forces is eligible for the resident tuition rate for the duration of the spouses or dependents continuous enrollment at a state educational institution regardless of whether the person serving on active duty continues after the spouse or dependent is accepted for enrollment in the state educational institution to satisfy certain resident rate tuition eligibility criteria.

If a member of the armed forces or the spouse or dependent child of a member pays tuition at a public institution of higher education in a State at a rate determined by subsection a the. This means that military kids are eligible for in-state tuition where they are actually living in conjunction with their parents job. This is separate from the Federal GI Bill.

A Veteran using educational assistance under either chapter 30 Montgomery GI. In state tuition for military service members dependents and veterans State law provides exceptions for active-duty military personnel their dependents and veterans when it comes to being considered as domiciled in Virginia. Military dependents also qualify for in-state rates while using their sponsors GI Bill benefit.

Https Www Utep Edu Student Affairs Mssc Files Docs Yellow Ribbon Application Fy17 Pdf

Us Democrats Did Not Block Bill On Tuition For Children Of Vets Killed In Action Fact Check

Us Democrats Did Not Block Bill On Tuition For Children Of Vets Killed In Action Fact Check

Admissions Information For Military And Veteran Students At Penn State Undergraduate Admissions

Admissions Information For Military And Veteran Students At Penn State Undergraduate Admissions

Http Legalresidency Cofc Edu Documents Updated 20independent 20application Pdf

States That Offer Free Tuition To Spouses Dependents Military Benefits

States That Offer Free Tuition To Spouses Dependents Military Benefits

New York Says No Free Tuition To Gold Star Families Daily Mom Military Free Tuition Tuition Star Family

New York Says No Free Tuition To Gold Star Families Daily Mom Military Free Tuition Tuition Star Family

Military Spouse Education Benefits Military Benefits

Military Spouse Education Benefits Military Benefits

Https Onestop Fiu Edu Assets Forms Ad Non Resident Tuition Waiver Form Pdf

Our Guide To Military Scholarships For Veterans Dependents And Spouses The Scholarship System

Our Guide To Military Scholarships For Veterans Dependents And Spouses The Scholarship System

Http Ecampus Oregonstate Edu Online Degrees Military Va Benefits Matrix 2020 Pdf

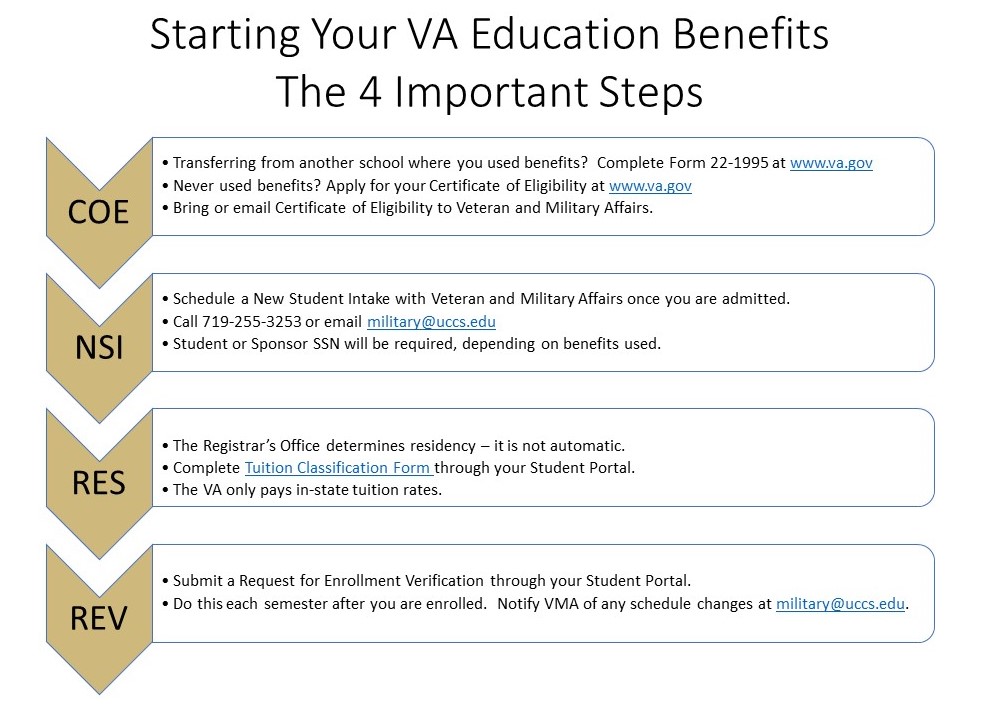

Transfer Dependent Benefits Veteran And Military Affairs

Transfer Dependent Benefits Veteran And Military Affairs

States That Offer Free Tuition For Vets Military Benefits

States That Offer Free Tuition For Vets Military Benefits

What You Need To Know About Gi Bill Benefits And Tax Deductions Columbia Southern University

What You Need To Know About Gi Bill Benefits And Tax Deductions Columbia Southern University

Gi Bill Top Top Questions Answered Military Com

Gi Bill Top Top Questions Answered Military Com

Military Spouse Tuition Assistance Military Benefits

Military Spouse Tuition Assistance Military Benefits

More People Using Transferred Gi Bill Eligible For In State Tuition Military Com

More People Using Transferred Gi Bill Eligible For In State Tuition Military Com