Rating Us Government Bonds

bonds government rating wallpaperPublic finances and the absence of a credible fiscal consolidation plan issues that were highlighted in the agencys last rating review on March 26 2020. Political picture which raised the uncertainty of wrangling associated with issues such as the debt ceiling.

The most well-known international bond rating agencies are Moodys ticker.

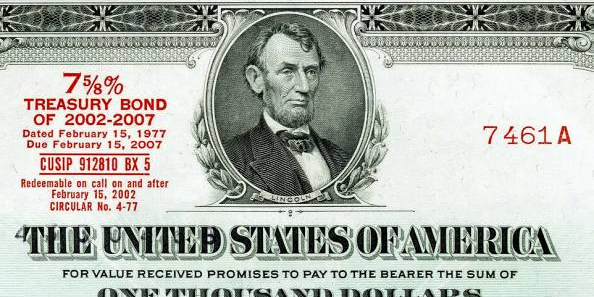

Rating us government bonds. Where the government bond is issued on behalf of a country with its own currency and central. The bond specifies what interest rate coupon will be paid and at which times during the life of the bond and when the principal funds also known as face value will be returned. Then at the prompt dial 866-330-MDYS 866-330-6397.

Get updated data about US Treasuries. Historically the United States Government Bond 10Y reached an all time high of 1582 in September of 1981. MCO Standard Poors SPGI and Fitch.

The ratings are published by credit rating agencies and provide evaluations of a bond issuers financial strength and capacity to repay the bonds principal and interest according to the contract. Fitch Ratings changed on Friday 31 July 2020 the United States sovereign rating outlook to negative from stable and affirmed the debt grade at AAA citing as main trigger behind the revision the ongoing deterioration in the US. These are assigned by credit rating agencies such as Moodys Standard Poors and Fitch which publish code designations such as AAA B CC to express their assessment of the risk quality of a bond.

US government bond markets saw a steep sell-off and yields subsequently rose. Bond ratings are representations of the creditworthiness of corporate or government bonds. Timetable of United States credit ratings by SP Moodys Fitch and DBRS agencies.

Enjoyed the gold standard of triple-A ratings from all three agencies Fitch Moodys and SP from the time of their recognition as standards by the SEC until the SP downgrade in early August 2011. US government bond markets have undergone. US 10 Year Note Bond Yield was 116 percent on Thursday February 11 according to over-the-counter interbank yield quotes for this government bond maturity.

Back to United States Government Bonds - Yields Curve. Symbol means a positive outlook assigned by the rating agency. New York July 13 2011 -- Moodys Investors Service has placed the Aaa bond rating of the government of the United States on review for possible downgrade given the rising possibility that the statutory debt limit will not be raised on a timely basis leading to a default on US Treasury debt obligations.

The main way of assessing the risk of a government defaulting is through its rating from the three main credit rating agencies Standard and Poors Moodys and Fitch. From the perspective of its credit rating the most important event occurred in August 2011 when SP downgraded United States debt from AAA to its second-highest rating AA. Each has a rating system it uses to determine an issuers ability and.

Governments also issue bonds - in the UK they are referred to as gilts and in the US as treasuries. Texas Permanent School Fund prerefunded maturities only - 964559US5 964559UT3 964559UU0 964559UV8 964559UW6 964559UX4 964559UY2 964559UZ9 964559VA3. Fitch Ratings - Austin - 27 Jan 2021.

The primary reason SP cited for its downgrade was the lower degree of predictability in the US. Government enjoys the highest credit rating AAAAaa from two of the Big Three CRAs. Dial the ATT Direct Dial Access code for.

Bonds and Securities Information dealing with the purchase redemption replacement forms and valuation of Treasury savings bonds and securities is located on the TreasuryDirectgov website which is managed by the Bureau of the Fiscal Service. Normal Convexity in Long-Term vs Short-Term Maturities. 10 Years vs 2 Years bond spread is 1128 bp.

Symbol means a negative outlook. Find information on government bonds yields muni bonds and interest rates in the USA. Moodys assigns bond credit ratings of Aaa Aa A Baa Ba B Caa Ca C with WR and NR as withdrawn and not rated.

The United States 10Y Government Bond has a 1243 yield. The 10-year yield rallied as high as 130 its highest since February 2020. Standard Poors Fitch and MoodysThe list also includes all country subdivisions not issuing sovereign bonds but it excludes regions provinces and municipalities issuing sub-sovereign bonds.

Fitch Ratings has withdrawn its ratings for the following bonds due to prerefunding activity--White Settlement Independent School District TX unlimited tax refunding bonds series 2012 gtd. Central Bank Rate is 025 last modification in March 2020. This is a list of countries by credit rating showing long-term foreign currency credit ratings for sovereign bonds as reported by the largest three major credit rating agencies.

When you purchase a bond you are effectively giving a loan to the bond issuer. Government bond risks You might hear investors say that a government bond is a risk-free investment. With government bonds also known as sovereign bonds a national government borrows money to fund its operations.

How To Invest In Bonds Keep Your Portfolio Diverse

How To Invest In Bonds Keep Your Portfolio Diverse

/shutterstock_164681615-5bfc2b6e46e0fb005119ac66.jpg) U S Bonds Vs Bills And Notes How Are They Different

U S Bonds Vs Bills And Notes How Are They Different

Are Chinese Credit Ratings Relevant A Study Of The Chinese Bond Market And Credit Rating Industry Sciencedirect

Are Chinese Credit Ratings Relevant A Study Of The Chinese Bond Market And Credit Rating Industry Sciencedirect

What Are Government Bonds Learn About Bonds Ig Uk

What Are Government Bonds Learn About Bonds Ig Uk

Bond Ratings Explained Interpreting The Bond Rating System Credit Rating Agency Investing Investment Services

Bond Ratings Explained Interpreting The Bond Rating System Credit Rating Agency Investing Investment Services

A Guide To The Chinese Fixed Income Markets J P Morgan Asset Management

A Guide To The Chinese Fixed Income Markets J P Morgan Asset Management

5 Bond Market Facts You Need To Know The Motley Fool

5 Bond Market Facts You Need To Know The Motley Fool

Bond Issuers Definition And Explanation Corporate Finance Institute

Bond Issuers Definition And Explanation Corporate Finance Institute

Ally Invest Treasury Bills Bonds Notes Buying At Auction 2021

Ally Invest Treasury Bills Bonds Notes Buying At Auction 2021

11 7 12 Exxon Is Now Safer Than The Us Government Financial Health Government Debt Corporate Bonds

11 7 12 Exxon Is Now Safer Than The Us Government Financial Health Government Debt Corporate Bonds

Wall Street Rant Many Government Bonds Yielding Less Than United States Government Bonds Financial Charts Government

Wall Street Rant Many Government Bonds Yielding Less Than United States Government Bonds Financial Charts Government

/-1000-denomination-us-savings-bonds-172745598-cdf4a528ed824cc58b81f0531660e9c9.jpg) Treasury Bills T Bills Definition

Treasury Bills T Bills Definition

.png) Bond Rating Definition Example Investinganswers

Bond Rating Definition Example Investinganswers

/AgencyBonds_LimitedRiskAndHigherReturn32-9a575588ab6b4e4484cc80d0a8f9710c.png) Agency Bonds Limited Risk And Higher Return

Agency Bonds Limited Risk And Higher Return

Investor S Guide To U S Treasury Securities Project Invested

Us Treasury Bonds Interest Co Nz

Us Treasury Bonds Interest Co Nz

:max_bytes(150000):strip_icc()/us_treasury_bond-5bfc2f31c9e77c002631087a.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Swap_Spread_Apr_2020-01-9ff4068939e742ca9cc066d6d7d481b3.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Bonds_Rated_Sep_2020-01-b7e5fc745626478bbb0eed1fb5016cac.jpg)